Sustainability at Capital Bay

Sustainability arises where people and nature work together - an interplay that guides us at Capital Bay. Our aim is to combine economic success with ecological and social goals in order to create a future worth living in the long term.

Sustainability over the entire life cycle of real estate

For us at Capital Bay, sustainability is more than just a strategic goal - it is an indispensable part of our business activities and affects all areas of life and work. As a real estate investment and asset manager with a holistic real estate platform, we understand the urgency of protecting our planet's natural resources while creating future-proof, competitive real estate solutions that meet the highest standards.

Our joint venture with Daiwa House Modular Europe is a key milestone on this path. This partnership enables us to offer products today that are manufactured according to the cradle-to-cradle principle and meet the sustainability requirements of tomorrow. This modular construction method, which we are currently implementing in projects such as the residential construction project in Berlin-Lichtenberg with over 1,500 units, represents an environmentally friendly, resource-saving solution and sets new standards in the real estate industry.

Our understanding of sustainability is based on a holistic approach that seamlessly integrates all areas - from investment and real estate development to property management and operation. This enables us to minimize efficiency losses and conserve valuable resources. In new construction, we rely on modular, industrial construction methods. For existing properties, we develop individual strategies that cover the entire spectrum of measures, from planned maintenance and repair to complete repositioning and conversion. The aim is to extend the life cycle of properties while ensuring sustainable cash flows. In doing so, we are aware that it is essential to align our products and services with the future needs of a changing society in order to ensure the sustainable use of capital as a resource.

For us, sustainability means more than program efficiency. We can only achieve our goals if we place the people who work for us as our most valuable resource at the center of our sustainability strategy. We make targeted investments in promoting young talent. One example of this is our dual study and training positions or the intensive study program Real Estate Transaction Management, which we developed together with the IREBS International Real Estate Business School.

Here we would like to give you an insight into our progress to date and future plans. We invite our partners, investors and all stakeholders to join us on this journey and work together towards a sustainable and liveable future.

George Salden

CEO, Capital BaySustainability that unites people, nature & value

Our vision at Capital Bay is to create attractive and, in particular, affordable living spaces for the respective user segments that offer a high quality of life and increase in value in the long term. Our strategy is to combine social quality with long-term profitability and ecological innovation in a balanced relationship.

As a real estate investment and asset manager, we act on behalf of owners to reconcile their economic interests with ecological performance improvements. We attach particular importance to solutions that offer measurable added value for the parties involved, i.e. the owners, the users and also for our environment. By integrating this strategic bundle of objectives into the entire life cycle of a property - from investment and development through to operation and management and, if necessary, recycling at the end - we create a solid foundation for sustainable management. To achieve this, we have defined key areas of focus.

Our business model

Capital Bay pursues a vertically integrated business model that aims to actively manage and increase the value of real estate in all market phases. Our focus is on all forms of residential and commercial residential concepts as well as logistics real estate in the commercial sector.

By implementing sustainability aspects throughout the entire value creation process, we ensure that our projects not only meet the expectations of our investors in the long term, but also have a positive impact on the environment and society.

Our approaches include:

- Modular construction methods in new buildings and optimized construction in existing buildings to reduce costs and improve performance

- Umfassende Betreibermodelle in strategischer Partnerschaft zur Realisierung sozial integrierter Wohnkonzepte für alle Lebensphasen. Diese Modelle werden entweder durch Property Management oder langfristige Pachtverträge umgesetzt.

- Use of digital solutions developed in-house or by partners such as Evana and Onsite Immoagent to increase efficiency and optimize our property management

ESG integration into business and operational structures

Capital Bay Group (Capital Bay) relies on comprehensive processes to anchor sustainability strategies in all areas of the company and present them transparently.

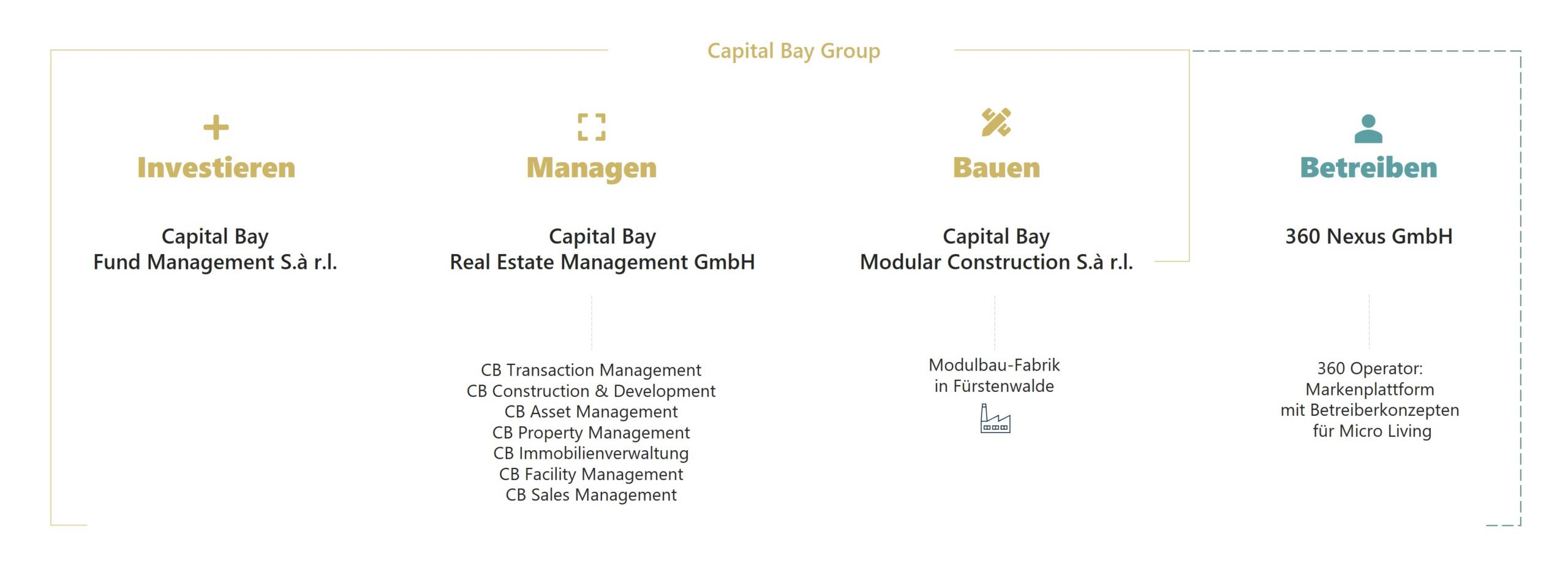

Capital Bay is divided into four main business areas: Invest, Build, Manage and Operate. This structure supports the integration of sustainability strategies in all business and operational activities and creates transparency.

Invest

The Investment division is represented by the subsidiary Capital Bay Fund Management S.à r.l., based in Luxembourg. Her main task is to develop and manage the investment strategy and structure direct and indirect real estate investments. As a result, different investment strategies can be implemented globally and fully regulated.

Manage

The Manage division is managed by Capital Bay Real Estate Management GmbH. Specialized subsidiaries are organized under this umbrella:

CB Transaction Management: Responsible for transaction management

CB Construction & Development: Responsible for project development, construction management, evaluation and performance measurement

CB Asset Management: Focused on strategic and operational real estate management

CB Property Management: Responsible for rental management

CB Immobilienverwaltung: Carries out property management

CB Facility Management: Offers comprehensive facility management

CB Sales Management: Takes over real estate sales

Building

Capital Bay Modular Construction S.à r.l. and Daiwa House Modular Europe GmbH (Daiwa House) have founded a joint venture for innovative, modular and sustainable construction. The core of this joint venture is the modular construction factory in Fürstenwalde enables efficient series production of environmentally friendly and modular housing modules to create cost-efficient, resource-saving housing solutions.

Operate

360 Nexus GmbH (360 Operator) will take over the operating division. This unit acts as the exclusive strategic partner of Capital Bay. 360 Operator offers comprehensive operator concepts for various forms of housing, including hotels, student accommodation and senior residences, and ensures the efficient operation of properties. Properties can be let both on the basis of individual rental agreements in the property management model and via lease agreement models, thus ensuring flexible and needs-based management solutions.

Our programs, investment processes and organizational and operational structures are consistently geared towards long-term improvements in performance, competitiveness and value creation. ESG reporting on environmental, social and governance issues is designed to enable investors and stakeholders to understand Capital Bay's sustainability strategy and assess the progress made.

Sustainability in new and existing buildings

Our aim is to present convincing solutions that combine economic, social and ecological benefits. In doing so modular solutions in new buildings, the repositioning or conversion and energy-efficient refurbishment of existing buildings key components of our strategy.

Modular construction methods

We rely on modular construction methods for new-build projects that reduce construction costs and environmental impact. Together with our joint venture partner Daiwa Modular Europe, we are planning to produce around 100,000 modular units by 2030. Thanks to the high degree of prefabrication and the reusability of these modules, we are aiming to reduce CO₂ emissions by at least 50% compared to traditional construction methods.

Recycling of buildings

Centrality and inner-city locations offer particular advantages in terms of performance in the areas of mobility, social and service quality. In addition, recycling significant proportions of existing building fabric enables cost benefits to be realized and significantly reduces the consumption of natural resources and use of public infrastructure associated with a construction project by avoiding transport. Capital Bay specializes in repositioning properties that are no longer competitive as core investments.

Energy-efficient renovations and incentives for sustainability

For existing properties in asset and fund management, we develop tailor-made actual/target roadmaps that enable a sustainable transformation step by step and without impairing ongoing use in line with the respective owner's objectives. As a partner, we support owners in applying for funding programs and implementing these measures in order to increase the attractiveness and profitability of their properties while also achieving ecological improvements. This includes the use of technologies such as intelligent heating, ventilation and lighting control systems, thermal insulation and heat recovery as well as the gradual conversion of heat generation to renewable energy sources.

Partnerships and cooperation as success factors

Unsere strategischen Partnerschaften sind wesentliche Bausteine zur Erfüllung unserer ESG-Ziele. Gemeinsam mit Daiwa House und unserem Exklusivpartner bieten wir modulare Bauweisen und umfassende Betreibermodelle für alle Lebensphasen des Wohnens an, die nicht nur einen sozialen Mehrwert bieten, sondern auch die Ressourcen schonen. Digitale Lösungen von 21st Real Estate, Evana und Onesite Immoagent unterstützen uns, den gesamten Immobilienlebenszyklus zu optimieren und so Transparenz und Effizienz im Immobilienmanagement zu steigern.

Capital Bay as a sustainable player on the capital market

Capital Bay combines its investment strategy with clearly defined sustainability goals that are aligned with the United Nations Sustainable Development Goals (UN SDGs or UNEP FI). It specifically supports seven of the 17 SDGs, including quality education, affordable and clean energy, sustainable cities and communities, and climate action. This integration creates a clear focus on environmental, social and economic added value that meets both stakeholder expectations and societal requirements.

In order to strengthen its position as a sustainable player on the capital market, Capital Bay consistently aligns its funds, investments and investment products with ESG standards. Compliance with the principles of the Global Reporting Initiative (GRI) and the integration of ESG criteria into investment processes ensure responsible and transparent capital allocation. Sustainable financial instruments make it possible to mobilize targeted capital for climate-friendly projects and offer investors a credible and future-oriented investment opportunity.

Transparency and quality management

Capital Bay strives to bring transparency and openness to all aspects of the company. Our management-processes in Transaction-, Asset-, and Property Management are certified to ISO EN 9001:2015 by TÜV and ensure a high level of security and trust for investors, tenants and partners. With an ESG TEAM, we ensure that all ESG measures are anchored throughout the company and are continuously optimized.

Sustainability in the company

Capital Bay is committed to a comprehensive corporate development strategy that takes all divisions and locations into account. At 12 locations in Germany and international offices in Luxembourg, Switzerland and Hong Kong, we are committed to constantly reducing the environmental footprint of our offices and processes. Our sustainable office initiatives include a mobility concept that promotes climate-friendly business travel and an all-electric vehicle fleet, as well as the use of renewable energy and measures to increase energy efficiency. We are committed to a paperless office and promote waste separation and environmentally friendly procurement.

Our employees support our commitments to ethical business practices and international standards - including protecting human rights, fighting corruption and ensuring fair labor standards. As a further component of our corporate culture, we offer all employees a safe, fair and respectful working environment. In addition, we promote open communication through flat hierarchies, encourage the exchange of ideas and involve employees in decision-making processes.

Capital Bay is committed to promoting and training young talent and offers its employees flexible working models and bonus programs. These measures are part of our commitment to promoting environmental protection and resource efficiency at all levels.

Sustainability that makes sense for everyone.

Ecological performance, economic attractiveness and user satisfaction - Capital Bay combines these goals in its strategy.

In particular, Capital Bay derives from its sustainability strategy the obligation to consistently reduce the consumption of natural resources, especially fossil fuels. We are aware that this can only be achieved in the medium and long term in harmony with the wishes and needs of the users of our properties. We see a particularly promising perspective in promoting the use of innovative technologies and processes wherever they are not only cheaper and more attractive for users, but also offer better ecological performance.

Modular new build

As part of a joint venture with Daiwa House Modular Europe, Capital Bay is focusing on a recyclable, modular construction method for new buildings that makes the life cycle of properties more efficient. Capital Bay is responsible for securing land, obtaining building rights and capital raising through cooperation with European and international investors, while Daiwa House is responsible for construction and technical implementation.

The joint venture acts as a one-stop store for modular housing solutions and combines the modular construction expertise of Daiwa House with the investment and asset management know-how of Capital Bay. Investors benefit from services from a single source - from the acquisition of land and building rights to financing and the long-term management of new-build products that meet the latest energy standards. In addition, strategic partner 360 Operator develops customized concepts for operations that are geared towards different target groups.

In 2022, the joint venture acquired the former site of the steel construction company Reuther STC in Fürstenwalde and converted it for the production of modular building elements, which are primarily used for residential construction. The plant in Fürstenwalde not only creates 300 modern industrial jobs in the Berlin-Brandenburg region, but can also produce up to 50,000 modules per year in the future. The high degree of prefabrication of the modules reduces the construction time on site by up to 50%, while comprehensive quality control at the plant minimizes construction defects and reworking. The modular construction method offers significant ecological advantages over conventional solid construction:

- Each module has individually controllable ventilation with heat recovery and heat generation, which avoids line losses and provides users with direct feedback on their energy consumption. In addition, the technology is very easy to maintain, there are no overly complex features and system components and it can be replaced and updated at any time.

- Modular buildings are much easier to recycle than solid structures.

The modules are designed so that they can be dismantled at their original location at the end of their life cycle, undergo a comprehensive refurbishment at the factory and then be reused at a new location. This method enables CO₂ emissions to be reduced by around 50% compared to conventional construction methods. Further information on the sustainability of Daiwa House's modular construction method can be found in the partner´s ESG report.

First joint project and regulatory framework

The joint venture's first project, a Gewobag housing project in Berlin-Lichtenberg, comprises over 1,500 apartments and is considered the largest modular housing project in Europe. Around 3,000 modules are to be built to create urgently needed living space in urban areas.

To simplify the approval process for modular construction, Capital Bay and Daiwa House are working to standardize type approvals. Standardized regulations are crucial to enable wider adoption of sustainable modular construction and accelerate the implementation of such projects on a large scale.

Construction measures in existing buildings

The revitalization of existing real estate portfolios through targeted conversion projects and building recycling represents a resource-saving and cost-efficient solution for vacant or inefficiently used existing properties. The focus here is on inner-city locations with existing infrastructure. The targeted recycling of existing buildings reduces land and material consumption as well as waste and offers a significantly better overall CO² balance compared to conventional construction methods in new buildings, taking into account the energy used in production and the period of use. The aim is to minimize the consumption of resources by recycling existing components as far as possible and at the same time to increase the attractiveness of the properties in the long term.

Capital Bay has the tools and the necessary experience to transform properties step by step in a sustainable and economically viable manner. In an initial pre-assessment, the actual performance is measured using a KPI set developed for commercial residential operator properties and possible measures are compared with the target performance in order to derive an optimized development strategy. In this way, structural or organizational measures can be assessed in terms of their costs and potential for improvement. Depending on the preferences and objectives of our clients, we also advise, organize and coordinate the certification of individual properties or entire portfolios, for example with BREEAM, but also with any other label.

In addition to strategic planning and advice on portfolio development measures, we specialize in the implementation of construction measures as project managers or general planners. The focus is on projects aimed at increasing competitiveness and improving performance. The decisive factor here is demonstrating the quantitative benefits of performance-improving measures, specifically how a sustainable increase in value and earnings, access to funding, improved financial viability and a perceived increase in product benefits can be achieved.

This involves not only projects such as the gutting and conversion of former high-rise office buildings (boarding house/hotel, Lindenallee 4 in Essen), the conversion of historic industrial buildings (CIEE university campus, Gneisenaustr. 27 in Berlin) or the repositioning of dead malls (Mauritiuskirchhofcenter, Berlin), but also in particular the elimination of functional defects and necessary basic refurbishments with energy-related improvements to properties during ongoing operation:

- Complete line renovation and replacement of the air circulation system with heat recovery in the Phönix nursing home in Plauen

- Replacement of recirculated air with new systems with heat recovery Sophienhof care homes in Porta Westfalica and Sophienhof in Garbsen, including conversion in accordance with WTG

Portfolio management and development

As a real estate asset manager, Capital Bay pursues the goal of gradually developing the properties managed on behalf of our clients in a sustainable and economically viable manner. We manage the entire process, from strategic planning and coordination to the implementation of measures. Our aim is to use targeted measures to increase the residential value, reduce operating costs and improve the ecological performance of the properties at the same time.

Energy efficiency in portfolios and electricity from renewable sources

By using a control system to optimize heating systems, we achieve more energy-efficient operation and reduce operating costs. The system is planned to be used in around 1,000 residential units. Capital Bay prioritizes the use of electricity from renewable energy sources in the real estate portfolios we manage. Most owners share this strategy, and together we are continuously increasing the proportion of renewable energy in our portfolio.

Waste separation

Capital Bay creates opportunities for waste separation in the properties it manages and raises tenants' awareness of sustainable waste management. In certain cases, a service provider has also been commissioned to sort household waste retrospectively and thus implement the ESG strategy even in challenging properties.

Natural outdoor facilities

To promote biodiversity, Capital Bay is developing a concept for insect-friendly outdoor areas. Certain green areas are no longer mowed regularly, but left to nature. This creates space for insects and a natural food source in urban centers.

Mobility as a component of ecological performance

Die Wohnkonzepte von Capital Bay zeichnen sich durch strategisch gewählte Standorte aus, die den Alltag der Bewohner erleichtern und gleichzeitig den CO₂-Fußabdruck reduzieren. Eine zentrale Lage und eine hervorragende Anbindung an den öffentlichen Nahverkehr spielen eine zentrale Rolle.

Advantages for students

The residential projects are located in the immediate vicinity of colleges and universities. With a maximum journey time of 30 minutes by bus, train or bicycle, students can reach their educational institutions quickly.

Flexibility for working people

For commuters, the locations offer short distances to central business districts and commercial areas. The proximity to train stations or main transport hubs not only makes the journey to work more efficient, but also less stressful. The integration of shared mobility services such as e-scooters or car-sharing platforms on the site also enables sustainable transportation.

Sustainable mobility solutions

Additional mobility options are being created in many projects, including:

- Charging infrastructure for electric vehicles

- Car sharing services directly on the premises

- Access to bike rental and repair stations

These well thought-out mobility solutions are not only practical, but also promote the reduction of individual emissions and strengthen the sustainability goals of the housing projects. Overall, they help to meet the needs of students, professionals and families alike.

Ecological performance at our company locations

Capital Bay has set itself the goal of making the operation of its company sites more environmentally friendly. This is reflected in a variety of measures in the areas of mobility, energy consumption, waste management and sustainable procurement.

Mobility concept

One key aspect is the promotion of environmentally friendly mobility. Business trips of less than 200 km are always carried out by train at Capital Bay. All air travel is calculated on a carbon-neutral basis and our vehicle fleet is gradually being converted to fully electric vehicles. We offer our frequent travelers a choice between a company car and a BahnCard 100. To further reduce our environmental impact, our vehicles are produced exclusively in Europe. In addition, the use of green electricity is ensured at our locations and employees are trained in energy-saving driving behavior. Business trips are only undertaken when absolutely necessary. Stattdessen sind virtuelle Meetings bevorzugt.

Waste separation

In the properties we manage, we create opportunities for waste separation and raise tenants' awareness of sustainable waste management. In some cases, we use service providers for tenant training and subsequent waste sorting in challenging properties.

Energy efficiency

To optimize energy consumption in our office buildings, we use timers and motion detectors for lighting wherever possible and try to adjust heating and ventilation according to the requirements of the respective users.

Sustainable procurement

Sustainable procurement practices are another important lever for improving our environmental footprint. When purchasing, we give preference to environmentally friendly products and services, choose suppliers with low CO₂ emissions and reduce transportation routes wherever possible.

No business cards

Since 2024, we have deliberately dispensed with printed business cards. Thanks to digital alternatives, we can exchange information easily and in an environmentally friendly way, which supports our sustainability strategy.

Paperless office

Our aim is to keep paper consumption in our offices as low as possible. Although we (still) occasionally use printouts, we rely primarily on digital working methods to minimize the consumption of resources. Digital signatures, digital document storage and the use of digital rental agreements support this process.

Social quality for living in all phases of life

Ein zentraler Bestandteil unseres Geschäftsmodells ist die Zusammenarbeit mit unseren strategischen Partnern. Unter dessen Dach vereinen wir verschiedene Betreibermarken, die alle Bereiche des gewerblichen und wohnwirtschaftlichen Wohnens abdecken. Ergänzt wird das Angebot durch die stationäre Pflege unter der Marke Curata.

New approaches in WOHNEN

By combining and mixing different types of residential use, we offer neighborhood-like living solutions that are tailored to the needs of different phases of life. In addition to a noticeably higher social quality, this creates a very high potential for added value through networking and potential exchange of services between young people, families and older generations.

In addition to this vertical integration, through offerings such as a surrogate grandmother, neighborhood help or swap meets and the general promotion of communal, neighborly cooperation, we also aim to promote offerings for horizontal integration in the future, for example through the development or provision of products such as savings facilities and support in financial matters, working in old age or work-life balance.

We have already realized the following equipment and service offers:

- Intelligent home technology for barrier-free living in old age (e.g. for Der Marienbogen).

- Concierge- und Reinigungsservices für höchste Wohnqualität.

- Gemeinsam nutzbare Gemeinschaftsflächen, wie Coffee-Lounges, Fitnessräume und Outdoor-Bereiche. Speziell in unserer Studenten-Marke bieten wir Lernräume und Lounges innerhalb der Gebäude für ein kooperatives Lernen und die Vernetzung untereinander.

Promotion of art and culture in neighborhoods

Mit Kunst- und Kulturprojekten tragen wir aktiv zur Identitätsbildung und sozialen Vernetzung in unseren Quartieren bei. Im Klinke-Viertel in Magdeburg hat Capital Bay dem Künstler Martin Gerth alias Noize ein Bestandsgebäude für Street-Art- und Lichtkunstprojekte zur Zwischennutzung überlassen. Nach dem Abriss wird die Kunst in die neuen Gebäude integriert und bleibt ein fester Bestandteil des Quartiers. Solche Initiativen fördern den Dialog zwischen den Bewohnern und der umliegenden Gemeinschaft, was das soziale und kulturelle Leben in den Quartieren nachhaltig bereichert.

Capital Bay as employer

At Capital Bay, we see social responsibility not just as an external commitment, but as an obligation to provide our employees with a supportive, respectful and diverse working environment. We are committed to a corporate culture that promotes diversity, equal opportunities and inclusion and creates conditions that enable personal development and professional fulfillment. Our measures aim to take into account the individual life situation of each employee and promote the compatibility of career, family and personal development. With targeted programs for diversity, inclusion and further training, we create the basis for a strong, committed and sustainable team.

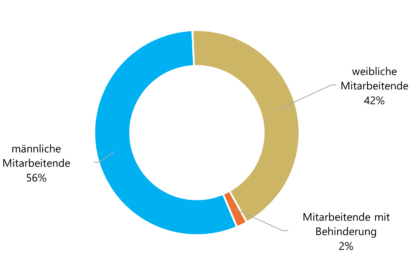

With around 180 employees, Capital Bay brings together a diverse workforce with different backgrounds and skills. Around 40 % of employees are female, around 55 % are male and around 2 % belong to a group with special needs. This distribution underlines the importance of diversity in our organization and highlights the need to actively promote inclusion.

Diversity and inclusion

One of our most important tasks is to see diversity as a strength and actively integrate it into our day-to-day work. Through targeted measures and initiatives, we promote a corporate culture in which all voices are heard and valued. Our workforce reflects the diversity of society. Employees from 10 different nationalities - from German to Eritrean to Brazilian - enrich our team with different perspectives, experiences, cultural backgrounds, social diversity and education. Capital Bay promotes an inclusive corporate culture through measures such as German courses and the introduction of a "Duz" culture, which strengthens exchange and cooperation at eye level.

Goal: By 2030, we want to further increase the proportion of international talent and specialists as well as people with disabilities and promote exchanges through programs.

Family friendliness at Capital Bay

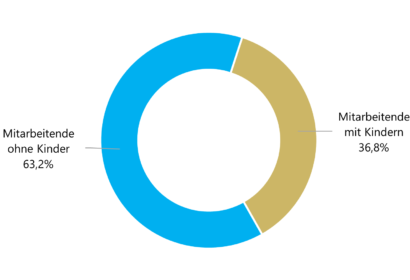

Capital Bay is committed to a corporate culture that actively promotes a good work-life balance. A significant proportion of the workforce has children - around 37% in total. In Leipzig in particular, this figure reaches around 48%, which underlines the company's attractiveness as a family-friendly employer. A high proportion of these employees (over 70%) also work full-time, which requires flexible and supportive working models. We offer our employees flexible working hours and parental leave models as well as part-time options.

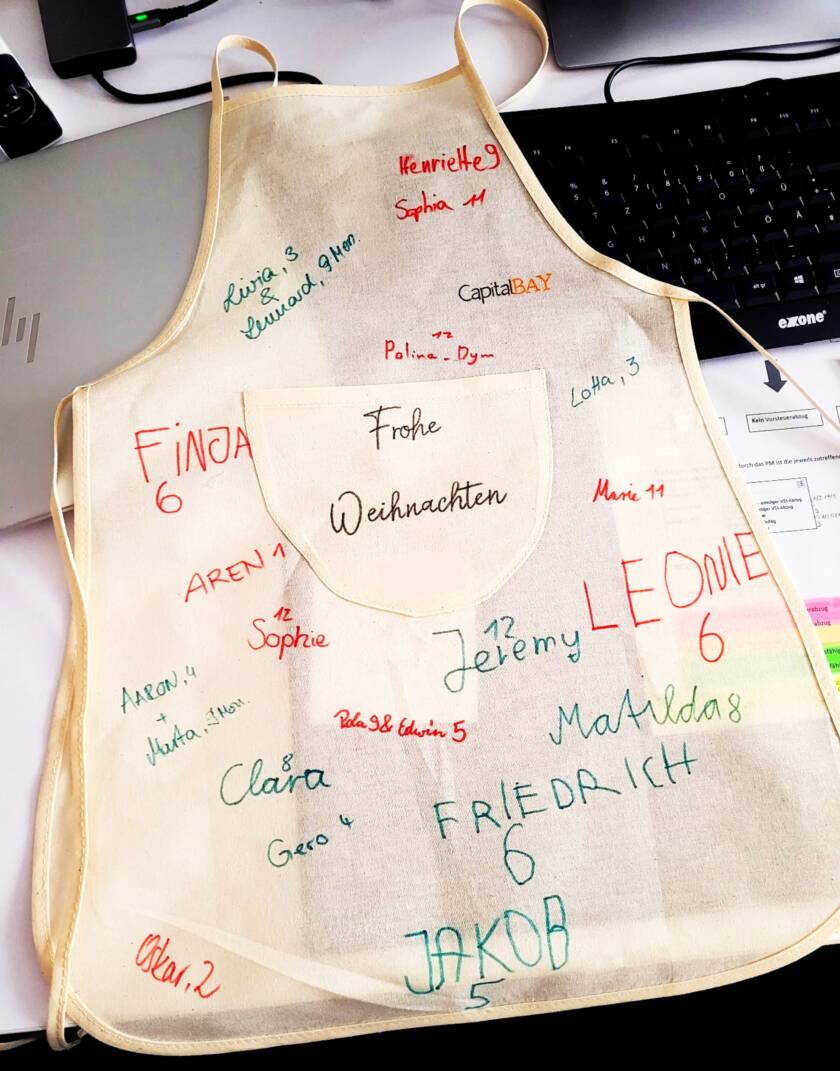

Rich in children and committed

One example of our family-friendly corporate culture is the annual CB children's Christmas party at the Leipzig site - the one with the most children in our company. Under the motto FROM COLLEAGUES FOR COLLEAGUES, a colourful programme is organized that gives our employees' children an unforgettable time and at the same time strengthens the sense of community within our company.

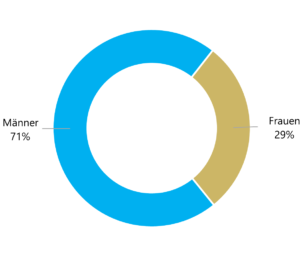

Promotion of women in management positions

With 28.6 % of management positions held by women, we recognize that we have made progress, but still have a long way to go to achieve equality. Diversity at management level is not only a social responsibility, but also a key success factor for Capital Bay, as diverse perspectives promote innovation and help us to make complex decisions more efficiently and customer-oriented.

We have therefore set ourselves the goal of increasing this proportion to 50 % by 2030. To achieve this, we are focusing on the following measures:

- Compatibility of career and family: We promote flexible working models, individual development plans and a corporate culture that takes the needs of families into account.

- Recruitment of international talent: Targeting women in underrepresented professional fields and in international markets should help to increase diversity in management positions.

Employees - Benefits

Our attitude: Flexibility and a sympathetic ear are our key benefits. At Capital Bay, we know that there is no universal benefit for everyone. That's why we attach particular importance to offering flexibility and responding to the individual circumstances of our employees. When life situations or challenges arise, we work together to find a way forward. We are proud of the fact that we have always found a solution. Our benefits

Employee development, training and further education

Capital Bay is committed to promoting young talent and offers a wide range of opportunities to develop in the real estate industry. In addition to training and study opportunities, we are actively involved in the further development and professionalization of specific specialist areas of the real estate industry. Our aim is not only to train students and trainees, but also to integrate them into our team in the long term.

Our USP: Capital Bay stands out as a holistic real estate platform that offers young talents a comprehensive insight into all areas of the value chain. From investment and management to construction and operation, students and trainees learn about all facets of the industry. This breadth makes us an attractive employer for entry into the real estate industry.

Success stories: In 2024, one trainee was successfully taken on as a property manager.

Promoting young talent through training and studies

Since 2019, Capital Bay has been awarding two dual study places each year in cooperation with the Berlin School of Economics and Law (HWR) in the business administration course with a focus on real estate management. Students are given the opportunity to optimally combine theory and practice by immersing themselves in all of Capital Bay's business areas - from investing and managing to building and operating real estate.

Success stories: Since the start of the program, four students have been successfully taken on and are now strengthening our team with their in-depth knowledge and practical experience. In addition, we have been offering an apprenticeship as a real estate agent every two years since 2019. The aim here is also to subsequently take on the trainee.

Integration into practice

Young talents at Capital Bay are given the opportunity to actively participate in projects and work in an interdisciplinary manner. One example of practical involvement is the visit to Daiwa Modular Europe's modular construction factory in the Netherlands, where our trainees and dual students were able to experience innovative construction processes and modern technologies at first hand.

Tour of the Daiwa House modular construction factory in the Netherlands

Employee development & training

Capital Bay considers the development of its employees to be an essential part of its social responsibility and the key to achieving its ESG goals in the long term. We currently offer individual training measures; however, we have identified the need to develop a structured internal training program that involves all employees and prepares them specifically for the challenges of the real estate industry.

Our existing individual measures include

- Participation in specialist training courses and external workshops.

- Support with job-related qualifications (e.g. real estate management specialist).

- Opportunities to participate in conferences and events.

- Individual training options on request.

These measures lay the foundation. By 2030, however, we aim to have a comprehensive internal training program that systematically addresses the needs of our employees and the requirements of the market. With the introduction of the CB ACADEMY internal training program by 2026, we aim to systematically prepare all employees for the challenges of the real estate industry. Our aim is for 100% of employees to take part in at least one training course per year by 2030 in order to ensure sustainable personnel development and meet future market requirements.

Initiative: Real Estate Transaction Management at the IREBS Immobilienakademie

Another milestone in the promotion of specialist knowledge was the establishment of the REAL ESTATE TRANSACTION MANAGEMENT course at the IREBS Real Estate Academy in 2022. In cooperation with IREBS, Capital Bay designed the intensive course of study to meet the high demands in the field of transaction management.

Our motivation: Transaction managers bear a great deal of responsibility, as the foundation for successful real estate investments is laid in transaction management. This intensive course provides interdisciplinary specialist knowledge, soft skills and a comprehensive insight into the latest trends in digitalization. Students are enabled to recognize and evaluate all sub-processes of a transaction and to use the full potential of digital tools.

The basis of our actions.

At Capital Bay, the legal framework conditions referred to as governance and the requirements for legally compliant action by the company (compliance) are of particular importance due to the fiduciary functions in fund and asset management. Organizational structures and instructions are fully implemented in the divisions in accordance with the legal provisions and requirements of the external supervisory bodies. In addition, regular internal training courses and events are organized by the Legal, HR and IT departments to raise employees' awareness of the risks of legal violations and to increase motivation for legally and ethically impeccable conduct and actions.

Corporate management and business ethics

Capital Bay is characterized by transparent and structured corporate management. Clear guidelines and established processes ensure sound decision-making and reliable control of operational business activities.

Our corporate culture is based on ethical behavior and integrity, which is reinforced by our Code of Conduct. This defines clear expectations for the conduct of employees and managers and forms the basis for trusting cooperation. In addition, whistleblowing systems enable confidential reporting and processing of violations, thereby promoting transparency and a sense of responsibility.

Integration of business partners

Capital Bay has taken organizational measures to systematically identify risks in the area of procurement and minimize them through preventive measures. Through centralized procurement, structured supplier selection and evaluation, we ensure that our procurement processes meet economic as well as social and ecological standards. In the procurement of services and construction work in particular, we have sensitized all employees involved to this issue through internal training.

The supply contracts concluded with our business partners contain provisions that enable us to identify and effectively sanction violations by suppliers of occupational safety regulations, illegal employment, illegal disposal or the use of primary products that are not approved in the EU. In addition, we intend to develop and motivate business partners operating within the framework of longer-term supply relationships to adopt standards introduced at CapitalBay, for example the almost complete certification according to ISO 9001 ff in CBREM, with regard to digitalization or the implementation of innovative products and processes.

Member of the UN Global Compact

Capital Bay has been a signatory to the UN Global Compact since 2021. This underlines our efforts towards sustainable and responsible corporate governance and compliance with international standards for human rights, labor standards, environmental protection and anti-corruption. The principles of the UN Global Compact are also directly incorporated into our procurement strategy. When selecting suppliers and in our procurement guidelines, we attach great importance to compliance with social and environmental standards.

Compliance and legal conformity

Capital Bay operates three regulated management companies based in Luxembourg. Our flagship company, Capital Bay Fund Management Sárl (CBFM), is fully regulated as an AIFM and complies with the requirements of the CSSF in Luxembourg. The regulatory standards derived from our sustainability strategy ensure the secure management of the assets entrusted to us through consistent compliance with the law.

Capital Bay strictly adheres to all applicable laws, regulations and standards relating to its business activities. The compliance team in Luxembourg monitors compliance and ensures that the company does not carry out any activities that could violate applicable law. Training and awareness programs ensure that employees are informed about relevant regulations.

Capital Bay continuously reviews and optimizes its processes in order to meet regulatory requirements and the expectations of its partners.

Digitization and data protection

Data and cyber security measures are at the heart of our business strategy in all areas of the company. We continuously protect our systems to ensure their resilience to cyber attacks.

Capital Bay aims to comply with the requirements of the General Data Protection Regulation (GDPR) and the NIS 2 guidelines. We thus implement the applicable standards in the area of data protection and system security. Our ongoing security measures include update/patch management, system hardening, network security, content filtering, the use of encryption, IAM measures, monitoring and the performance of audits. With this comprehensive approach, we ensure that the data of our customers, partners and employees not only complies with legal requirements, but also meets high security standards.

Transparency and disclosure

High transparency and disclosure are central to Capital Bay. Stakeholders are given access to relevant information through regular financial and sustainability reports.

Capital Bay integrates the principles of the Global Reporting Initiative (GRI) into its reporting in order to ensure standardized and comprehensible communication of ESG data. By applying these recognized standards, the company strengthens transparency towards its stakeholders and promotes a uniform assessment of ESG performance.

Our transparency guidelines ensure free access to information on compliance and legal issues, such as data protection, complaints management and voting rights policy. These are updated regularly and are available to all stakeholders in the INVESTMENT section of the Capital Bay website. Investment– Capital Bay

Investment strategy

Digital expertise and strict risk management for resilient and sustainable investments.

We combine capital and responsibility by consistently integrating ESG criteria into our decision-making processes. By using technologies and data-based analyses, we not only ensure economic stability, but also specifically promote projects that make a positive contribution to the environment and society.

This approach enables us to identify risks at an early stage, maximize opportunities and put investments on a solid, ESG-compliant footing. With a combination of sound location analyses, state-of-the-art technology and social responsibility, we create long-term value that goes beyond economic success.

Data-based decision-making basis in transaction management

In transaction management, Capital Bay uses 21st´s data-based expertise to create well-founded market and location analyses. The platform analyses factors relevant to the property market such as vacancy rates, fluctuation, socio-demographic data, year of construction classes, weather data, public transport connections, price sensitivities and competition analyses at regional, city and district level. In addition, historical trends, demand forecasts and changes in the market environment are taken into account to enable a comprehensive market assessment.

With over 2,000 situation indicators and millions of raw data, the platform offers deep insights into more than 50 ESG-relevant criteria at macro and micro level. These include:

- Environmental aspects: Soil pollution, asbestos risk, heat days, earthquake and flood risks

- Infrastructure: availability of e-charging stations and local public transport

- Social factors: supply situation, educational opportunities and social mix

- Governance elements: risk analyses and regulatory site assessments

These comprehensive analyses not only support risk assessment, but also promote the integration of sustainability aspects into real estate management. They form the basis for specifically assessing and minimizing environmental, social and economic impacts.

Market Study Care

In addition to the analysis of general and ESG-relevant location criteria, Capital Bay offers Market Study Care, a web-based service that provides investors with detailed insights into the German care market. It supports targeted investments in socially relevant projects and combines demographic forecasts on the need for care up to 2030 and 2035 with competitive analyses and location-specific data such as the supply situation and demographic developments.

With precise analyses, the Market Study Care provides a scalable basis for investment decisions in the nursing and care sector. It helps to close social care gaps, promote accessibility and age-appropriate living and thus specifically strengthen the quality of life in the regions. By combining economic viability with social relevance, the Market Study Care contributes to Capital Bay's ESG strategy.

With precise analyses, the Market Study Care provides a scalable basis for investment decisions in the nursing and care sector. It helps to close social care gaps, promote accessibility and age-appropriate living and thus specifically strengthen the quality of life in the regions. By combining economic viability with social relevance, the Market Study Care contributes to Capital Bay's ESG strategy.

Sustainability risks as part of our investment processes

The systematic analysis of performance risks is a central and integral part of our investment processes.

The digital analysis tool from 21st makes it possible to identify physical risks such as extreme weather events and climate impacts at an early stage and integrate them into decision-making processes. This data-driven approach is expanded with our regular risk management process to include the assessment and monitoring of the following sustainability risks:

Conversion risk - impact on business activities:

Risk of permanent financial losses from the process of adapting to sustainable practices, e.g. costly refurbishment of real estate portfolios to be more energy efficient and resource efficient and to reduce CO2 emissions. The more abruptly the changes are implemented, the higher the potential losses could be. A changeover planned for the long term would therefore incur significantly lower costs than a short-term one.

Conversion risk - regulatory/reputational:

Risk of incurring financial losses by being fined for non-compliance with environmental, health, safety and/or labor laws during the transition process to sustainable practices. In the event of a sanction, Capital Bay Group's name would be published on the CSSF website, which could result in severe reputational damage.

Operational risk - occupational safety risk

Risk of reduced productivity and resulting delays in the construction phase, caused by a high rate of accidents at work and sick days for employees.

The above-mentioned risks have been integrated into our corporate guidelines. We have also updated our remuneration policy to take into account the above-mentioned sustainability risks and their impact on the decision-making processes for acquisitions. In addition, they have been made a fundamental component of our investment process, which is described in the portfolio management guideline. The assessment of sustainability risks is an integral part of the due diligence process as part of the internal portfolio management process for new acquisitions.

The combination of data-driven valuation methods and comprehensive risk management creates a sound basis for a sustainable and future-oriented investment strategy at Capital Bay.

Material adverse impacts (PAI - Principle Adverse Impacts) and our countermeasures

The Capital Bay Group primarily manages real estate funds. We recognize that real estate ownership is associated with certain negative environmental impacts, including

- High energy consumption

- Use of fossil fuels for heating systems

- Water wastage due to leaks or excessive pressure

- Interventions in ecosystems that affect biodiversity

Our ESG Policy provides a clear framework that supports our employees in responsibly integrating environmental, social and corporate governance aspects into their daily work. The aim is to promote sustainability, combat climate change and minimize risks.

As a company, we bear responsibility for our environmental footprint, our social impact and our corporate governance. Environmental, social and governance principles are firmly embedded in our business strategy and ensure the long-term sustainability of our company. We are convinced that compliance with ESG principles is crucial for sustainable value creation.

Our measures to reduce negative impacts

To minimize the negative impact of real estate investments, we focus on specific sustainability measures in the following areas:

- Promotion of renewable energies

- Installation of solar panels to reduce electricity consumption from fossil sources

- Installation of charging stations for electric vehicles to support the switch to low-emission mobility

- Increasing energy efficiency

- Improving building insulation to reduce heat loss and lower energy consumption

- Replacing fossil heating systems with modern, sustainable alternatives using renewable energies

- Conserving water and energy resources

- Monitoring water consumption and early detection of leaks

- Optimization of water pressure and consumption management to minimize waste of resources

- Reduction in maintenance and servicing costs thanks to more efficient systems

- Protection of biodiversity

- Preservation of natural ecosystems in the respective project areas

- Application of NO HARM practices during the construction phase

- Promotion of local biodiversity through targeted measures

These measures are part of our long-term strategy to reduce CO₂ emissions and promote sustainable investments.

Dealing with sustainability risks

Although Capital Bay considers sustainability risks in its fund investments, we do not currently systematically assess the principal adverse impacts of investment decisions on a consistent set of sustainability factors under Article 2(24) of the SFDR. This is due to the limited availability of the necessary data and resources to undertake a comprehensive analysis.

We are continuously working to collect relevant data for our assets under management, as required by Annex 1 of the SFDR Level II Regulation.

Remuneration Policy

The remuneration policy of Capital Bay and in particular of our fully regulated AIFM, Capital Bay Fund Management, is designed to promote responsible investment and integrate sustainability risks in accordance with the applicable regulatory requirements. It supports prudent risk management and contributes to long-term value creation for our investors.

Alignment with ESG Principles

Incorporating environmental, social, and governance (ESG) considerations into our remuneration framework is a key component of our commitment to sustainable business practices. The policy integrates ESG metrics to incentivize responsible decision-making and risk management across all levels of the organization. Identified staff members are evaluated not only on financial performance but also on their contribution to sustainability objectives.

Risk Management & Responsible Incentives

Variable remuneration is structured to discourage excessive risk-taking and promote sound risk management, including sustainability risks. This includes:

- Balanced performance criteria: Compensation is based on a combination of financial and non-financial performance indicators, including ESG-related targets.

- Long-term value creation: Performance assessments are conducted within a multi-year framework to ensure alignment with the long-term investment strategy and sustainability goals of the Alternative Investment Funds (AIFs) we manage.

- Risk adjustment measures: Remuneration decisions incorporate risk assessment mechanisms to account for potential adverse impacts on financial stability, ESG commitments, and investor protection.

Systematic analysis of risks associated with investments in developments and construction projects

Capital Bay Fund Management Sárl (CBFM) is supported in the selection and evaluation of potential investment opportunities by the expertise of CB Development and Construction Management. For example, the construction costs, deadlines and qualities specified in the business plans are checked for plausibility. In addition to a comparison with the company's own estimates and calculations, it is crucial to determine whether the people, service providers and suppliers involved in the respective projects have the necessary experience in the main factors influencing projects.

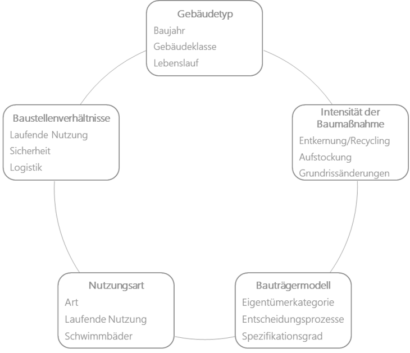

This concerns a) the project constellation or developer model b) the construction site conditions c) the scope of the construction project d) the type(s) of use and e) the type of building. If the necessary transfer of experience from completed projects is not available in one of these areas, there is a systematic risk that the desired cost, schedule and quality targets will not be achieved. Capital Bay only commits to investments where adequate coverage or risk assumption by third parties can be achieved.

This concerns a) the project constellation or developer model b) the construction site conditions c) the scope of the construction project d) the type(s) of use and e) the type of building. If the necessary transfer of experience from completed projects is not available in one of these areas, there is a systematic risk that the desired cost, schedule and quality targets will not be achieved. Capital Bay only commits to investments where adequate coverage or risk assumption by third parties can be achieved.

Sustainable financial products

Capital Bay combines its financial strategy with clearly defined sustainability goals that are aligned with the UN Sustainable Development Goals (SDGs). In particular, Capital Bay supports seven of the 17 goals, including quality education, affordable and clean energy, sustainable cities and communities, and climate action.

In March 2024, Capital Bay implemented a framework for sustainable financing based on the Green Bond Principles (GBP) 2021, the Social Bond Principles (SBP) 2023 and the Sustainability Bond Guidelines (SBG) 2021. This framework was reviewed by imug | rating as part of a second party opinion and confirmed as compliant with international standards. The issue proceeds from the sustainable financing instruments are used exclusively for projects with environmental and social benefits. The areas supported include

- Environmentally friendly buildings

- Renewable energies (photovoltaics, heat pumps)

- Circular economy and resource efficiency (modular construction methods)

- Affordable housing

- Social services (age-appropriate housing concepts, daycare centers, care facilities)

With this consistent approach, Capital Bay not only contributes to the achievement of global sustainability goals, but also creates long-term added value for the environment, society and all stakeholders.

Capital Bay - Your partner for holistic real estate solutions.

Get in touch

Address

A company of the Capital Bay Group

Social performance

A family-friendly corporate culture that promotes junior staff and sees social responsibility as a core principle.